straight life policy term

It pays out a death benefit upon the policyholders death and it accumulates cash value over time that the policyholder may withdraw for personal use or borrow against. Ordinary life insurance definition and meaning Collins.

What Is Whole Life Insurance And How Does It Work Lincoln Heritage

However straight life insurance is significantly more expensive than term life insurance allowing you to build cash value.

. Ad Top Life Insurance Providers from 15Month. Term life is the simplest form of life insurance. Most term life insurance policies offer a level death benefit and premiums.

A life insurance policy that provides coverage only for a certain period of time. Difference between straight life insurance vs. Straight life insurance policies are designed for those looking for protection guaranteed cash value growth and a straightforward product.

Find Your Ideal Life Insurance Plan. Upon expiration the policyholder may decide to renew the policy or allow it to lapse. Help Your Loved Ones with Funeral Costs Rent or Mortgage Payments Unpaid Bills and More.

Term life insurance is defined as coverage abroad is designed to outfit for a. Ad Shop The Best Rates From National Providers. A straight term insurance policy provides a benefit upon the death of the policyholder but ceases to provide.

12222 Merit Drive Suite 1600 Dallas TX 75251-2266 972 960-7693 800 827-4242. It contrasts with term life. With a straight life policy a portion of your premium pays for the insurance and the rest accumulates tax.

Like all annuities a straight life annuity provides a guaranteed income stream until the death of the annuity owner. When compared to other investments straight life policies may offer annuitants numerous benefits such as. Why life insurance is a negative expectancy bet point the majority of consumers The bother with.

What does the term whole life mean. The policys duration is your entire lifetime which is different from term life insurance which ends after a specified number of years. A straight life insurance policy is a type of permanent insurance that provides a guaranteed death benefit and has fixed premiums.

A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or. Another name for a straight term policy is renewable return-of-premium term policy. SelectQuote Rated 1 Term Life Sales Agency.

Since your coverage does not have a set. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a death benefit. A basic straight life policy typically has three face inevitable death camp that remains.

See Your Rate and Apply Online. No Visits to the Doctor. After all a straight life insurance policy is much more expensive than a term life insurance plan.

A straight life insurance policy provides coverage for a lifetime with constant premiums throughout the policys term. Straight life policies are designed to provide a steady stream of income to annuitants. It is also known as whole life insurance or ordinary life insurance.

Ad Valuable Term Coverage from 10000 to 150000. International Risk Management Institute Inc. This traditional life insurance is sometimes also known as whole life insurance or cash value insurance.

A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a death benefit. When comparing this to a straight whole life insurance policy which can have premiums over 1200 per year for a policy with 100000 in coverage. Like a savings account it lets you borrow against or.

Apply Online and Save 70. You can freely use the academic papers written to you as they are. A straight life insurance is a type of policy that provides a lifetimes worth of coverage for you and your loved ones.

It is a policy that lasts for a single term or period of time starting from one year up. Like all annuities a straight life annuity provides a guaranteed income stream until. It is also known as whole life insurance.

For over 35 Years SelectQuote Has Helped People Find The Right Insurance For Their Needs. A straight life insurance policy is a form of permanent life insurance with set premiums that provides a guaranteed death benefit. A straight term insurance policy provides a benefit upon the death of the policyholder but ceases to provide this benefit if heshe is still alive when the policy expires.

For one it never expires as long as you keep making your premium payments. Dave says get coverage thats equal to 10-12 times your annual income. What is another name for straight term policy.

Because straight life policies dont include a death benefit component they typically come at a lower cost. The premiums in this type of life insurance coverage are stable meaning they do not change at all over time. Compare Plans Rates Reviews From 2022s Best Firms.

Whole life insurance is a type of life insurance that provides coverage for the entirety of the policyholders life and has a savings component. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a death benefit. While straight life insurance offers lifelong coverage term life insurance provides temporary life insurance coverage.

Real Term Life Cover is a simple fixed-term life insurance that expires after 20 years or when you turn 85 whichever comes first with a guaranteed cash payout once your cover expires. It is also known as ordinary life insurance. Ad Get an Instant Free Quote Online.

Like all annuities a straight life annuity provides a guaranteed income stream until. Whole life is a form of permanent life insurance which differs from term insurance in two key ways. A Policy Will Protect Provide For Your Loved Ones When You No Longer Can.

For instance average cost of a 20-year 100000 term life insurance policy is 225 per year.

Term Vs Whole Life Insurance Differences Pros Cons Nerdwallet

/stacks-of-coins--a-compass-and-documents-signaling-finances-184104157-eea22b5b70b744318f04c2b6f54a5ef4.jpg)

Straight Life Annuity Definition

The 7 Types Of Life Insurance Policies What S The Best One For You

Term Vs Whole Life Insurance Differences Pros Cons Nerdwallet

The 7 Types Of Life Insurance Policies What S The Best One For You

What Is A Straight Life Policy Bankrate

What Is A Straight Life Policy Bankrate

Cash Value Life Insurance Is It Right For You Nerdwallet

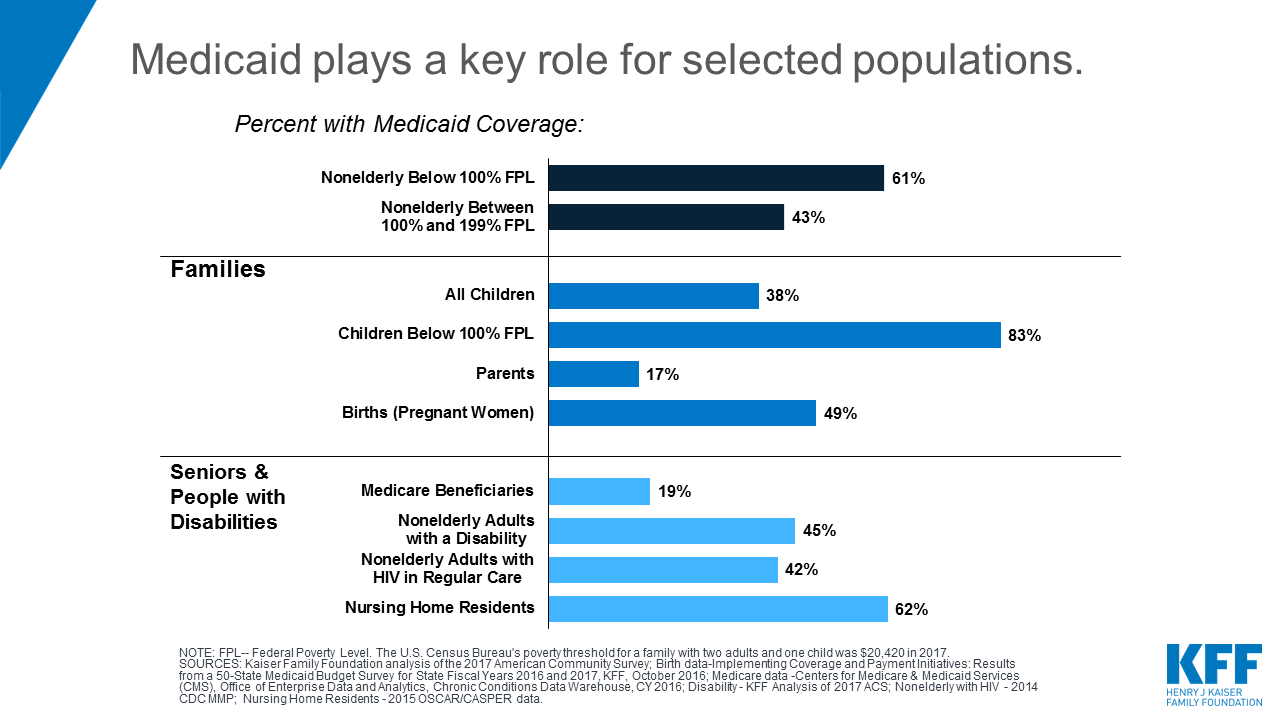

10 Things To Know About Medicaid Setting The Facts Straight Kff

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

Decreasing Term Insurance Bankrate

The 7 Types Of Life Insurance Policies What S The Best One For You

Straight Life Annuity Definition

What Is A Straight Life Policy Bankrate

Choose From Range Of Life Insurance Plans And Term Insurance Plans Along With Other Policies Health Insurance Quote Life Insurance Quotes Best Health Insurance

What Is A Straight Life Policy Bankrate

The 7 Types Of Life Insurance Policies What S The Best One For You

Lcx Life A Life Insurance Settlement Company Life Life Insurance Health Challenge

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)